Embarking on a journey, whether for leisure or business, brings excitement and anticipation. However, amidst the thrill of exploring new destinations, there are potential risks and unforeseen circumstances that can disrupt even the most meticulously planned trips. Travel insurance acts as a safety net, providing travelers with much-needed financial protection and peace of mind. In this blog post, we will delve into the world of travel insurance, discussing its benefits and essential tips on differentiating between a good and a bad policy.

What is Travel Insurance?

Travel insurance is a specialized type of insurance designed to protect travelers against various risks and expenses they might face while on a trip. It offers coverage for a wide range of situations, including trip cancellations, medical emergencies, baggage loss, flight delays, and other travel-related mishaps. Travel insurance policies can be purchased for single trips or as annual plans, catering to different types of travelers.

Benefits of Travel Insurance

- Trip Cancellation/Interruption Coverage: Life is unpredictable, and sometimes circumstances may force you to cancel or cut short your trip. Travel insurance can reimburse non-refundable expenses, such as flight tickets, hotel reservations, and tour costs, in case of trip cancellations or interruptions due to covered reasons like illness, natural disasters, or travel advisories.

- Medical Emergency Coverage: Falling ill or getting injured while traveling can be daunting, especially in a foreign country with unfamiliar medical systems. Travel insurance typically covers medical expenses, hospitalization costs, and emergency medical evacuations, ensuring you receive proper medical care without worrying about the financial burden.

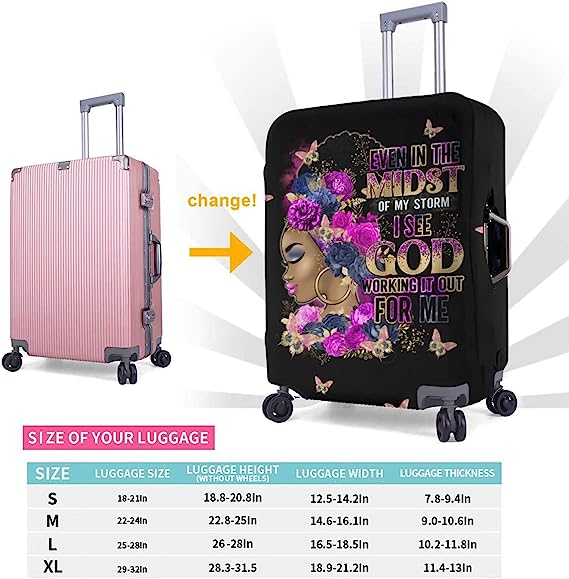

- Baggage and Personal Belongings Protection: Losing your luggage or having your personal belongings stolen during a trip can be distressing. Travel insurance provides compensation for lost, stolen, or damaged baggage and possessions, offering relief during a challenging situation.

- Flight and Travel Delays: Delays are not uncommon in the travel industry. A good travel insurance policy compensates you for additional expenses incurred due to flight delays or missed connections, such as accommodation and meals.

- Personal Liability Coverage: Accidents happen, and sometimes you may inadvertently cause injury to others or damage property. Travel insurance often includes personal liability coverage to protect you in such circumstances.

- 24/7 Assistance and Support: Reputable travel insurance providers offer round-the-clock assistance services, including medical advice, emergency cash transfers, and support during unforeseen events, ensuring you are never alone during emergencies.

How to Tell a Good Travel Insurance from a Bad One

- Coverage Options: A good travel insurance policy offers comprehensive coverage tailored to your specific needs. Read through the policy to ensure it includes the essentials like trip cancellation, medical expenses, baggage loss, and travel delays. Look for add-ons if you require extra coverage for activities like adventure sports or pre-existing medical conditions.

- Reputation and Reviews: Research the insurance company’s reputation and customer reviews. Look for feedback on how well the company handles claims and customer service. Reliable companies have positive reviews and transparent processes.

- Policy Exclusions: Understand the policy’s exclusions and limitations to avoid surprises during a claim. A bad travel insurance policy may have too many exclusions, making it challenging to claim benefits when you need them the most.

- Coverage Limits: Check the policy’s coverage limits for different categories. Make sure the limits are sufficient to cover potential expenses in your travel destination, especially for medical emergencies, which can be costly in some countries.

- Clear Terms and Conditions: A good travel insurance policy should have clear and easy-to-understand terms and conditions. Avoid policies with convoluted language or unclear clauses.

- Emergency Assistance Services: Verify that the insurance company provides 24/7 emergency assistance services. Prompt and reliable support during emergencies is crucial for a positive travel insurance experience.

Investing in travel insurance is an essential step in protecting yourself and your finances during your adventures. The benefits of having travel insurance far outweigh the costs, offering you peace of mind to fully enjoy your travels without unnecessary worry. Before choosing a policy, carefully review its coverage options, limitations, and reputation to ensure you select a reliable travel insurance plan that aligns with your travel needs. Remember, the right travel insurance can turn out to be your most valuable companion on your journey!

0 Comments